McKinsey: Banks branch in the Digital Age

Photo Source: Interactive Powers, Pexels. Creative Commons

Smart-branch in the digital age will dedicated 70% of services areas to self-services thank to advanced technologies.

Digital technology holds the key to the branch of the future.

Changing customer behavior and the emergence of new technologies spell not the end of the branch but rather the advent of the “smart branch.” Smart branches use technology to boost sales and improve customer experience significantly. When done right, applying the concept transforms the way a bank branch operates (reduced staffing), significantly lowers real-estate requirements, and alters customer interaction (targeted, relevant sales and service-to-sales programs)—with a resulting 60 to 70 percent improvement in branch effectiveness*, as measured by cost savings and increased sales.

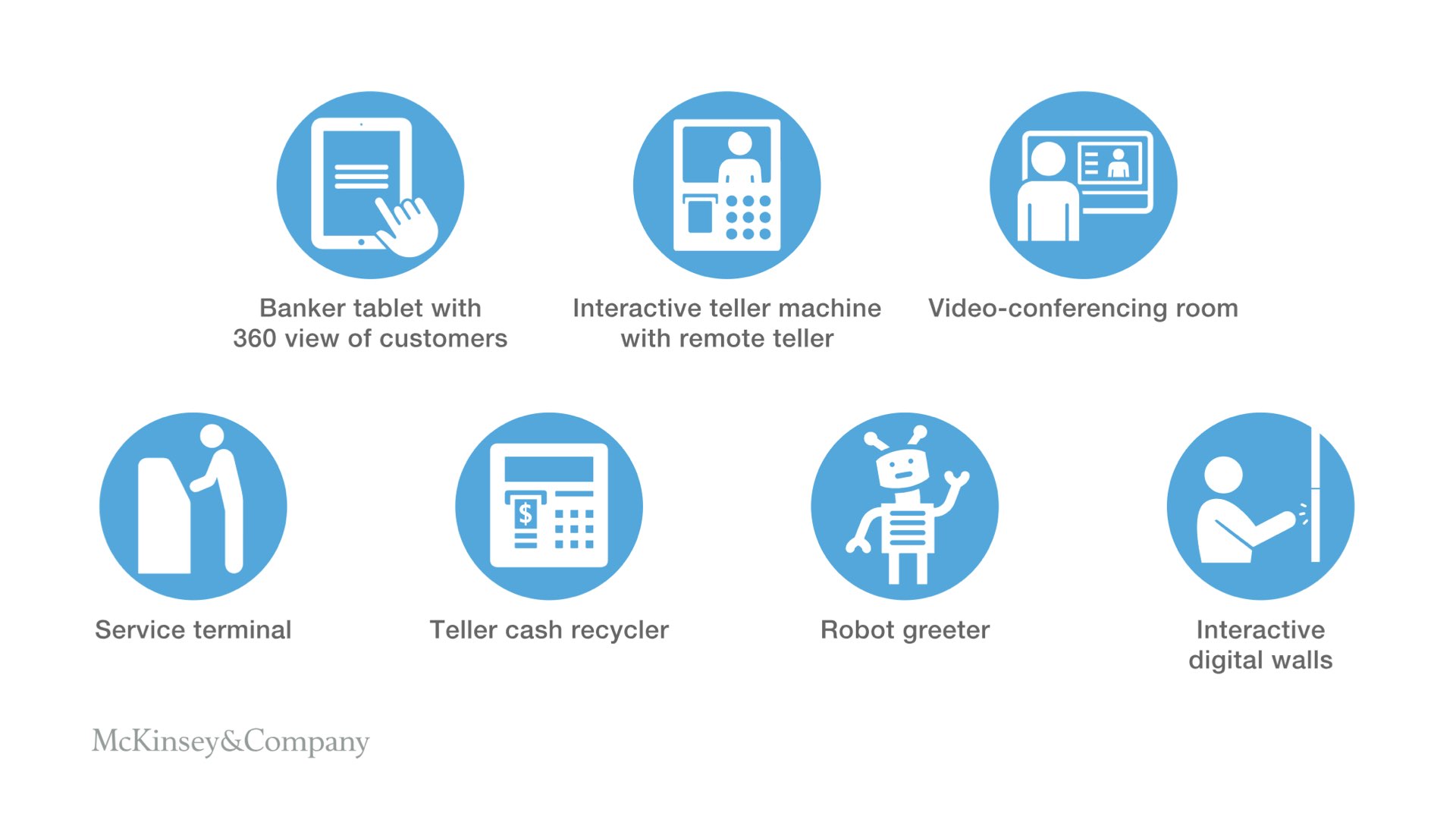

Smart-branch technology.

For retail banks, technology has several goals: the migration of transactions and sales to digital channels, 24/7 customer access for every interaction, a personalized approach to sales, and a unified, omnichannel user experience—meaning that customers get a seamless experience whether they are online, on an app, or at the branch. Customers should be able to come into a smart branch any time of day or night and get anything they need, from new products like loans or credit cards to service, quickly. And no matter what device they use, the user experience should be consistent.

Smart-branch formats.

In a traditional bank branch, 70 percent of the floor space is devoted to tellers and other assisted-sales and -servicing areas, with 30 percent dedicated to self-service. Smart branches flip this ratio and have a significantly smaller, simpler, and more streamlined footprint. Instead of wandering around trying to figure out where they need to go, customers are immediately approached by employees who guide them to intuitive pieces of technology or assist them directly on their tablets.

Smart-branch employs a range of technology solutions to provide full services at any time:

- Banker tablet with customer apps

- Interactive Teller Machines (ITM)

- Service Terminals

- Video Conference Rooms

- Interactive Welcome Screens & Walls

- Robot Greeter

Source: McKinsey - Research Study 2018

Interactive Powers - Streamline your business communications